utah solar tax credit form

Thats in addition to the 26 percent federal tax credit for solar. File for the TC-40e form you request this then keep the.

Buy A Degree University Of Florida Degree Transcript Fake Diplomas College Fake De Certificates Online University Of Florida Certificate Of Completion Template

Federal Tax Credit which will allow you to recoup 26 of.

. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is. A Secure Online Service from Utahgov. Log in or click Register in the upper right corner to get started.

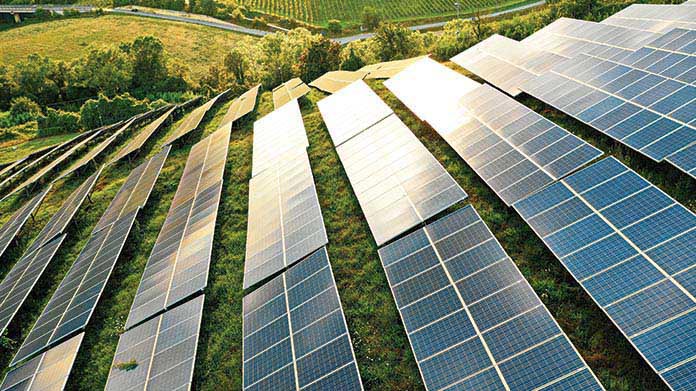

This rate is gradually decreasing. Your equipment AND installation. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects.

350 North State Suite 350 PO Box 145030 Salt Lake City Utah 84114 Telephone. Everyone in Utah is eligible to take a personal tax credit when installing solar panels. This program is no longer available for more information on Utah Renewable energy tax credits visit here.

Get Utah Forms Online. Go Solar today and your bills for the next 6 months will be covered. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum.

File for the TC-40e form you request this then keep the. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Utahgov Checkout Product Detail.

Where do I enter the information to receive the Utah state tax credit for solar. Create an account with the Governors Office of Energy Development OED Complete a solar PV application. Install a solar energy system.

Ad United States residents getting paid up to 1000 to go solar for no cost. Taxutahgovforms including fi ll-in forms Automated orders. Ad Free Online Solar Energy Installation Resource.

Find Utah Solar Prices By Zip. Renewable energy systems tax credit. Go Solar today and your bills for the next 6 months will be covered.

Claim the credit on your TC-40a form submit with your state taxes. Steps for Utilizing the Utah Solar Tax Credit. 2022 Discounts Available - Shop Deals To Get The Best Price On Solar - Only Takes 1 Minute.

Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification. All of Utah can take advantage of the 26. In 2022 the Utah residential solar tax credit stands at 25 percent of the eligible system cost or 800 whichever is less.

Application fee for RESTC. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar. In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000.

Get Utah Solar Panel Quotes. Get Up To 4 Free Solar Quotes By Zip. To claim your solar tax credit in Utah you will need to do 2 things.

Utah State Energy Tax Credits. The Alternative Energy Manufacturing Tax Credit is a nonrefundable tax credit for up. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a.

Ad United States residents getting paid up to 1000 to go solar for no cost. Utahs solar tax credit currently is frozen at 1600 but it wont be for long. Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project.

Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of. This form is provided by the Office of Energy Development if you qualify. 261 rows Energy Systems Installation Tax Credit.

File online for the fastest refund LINE-BY-LINE INSTRUCTIONS TC-40 Schedules CURRENT FORMS PDF Forms Instructions PAST YEAR INFORMATION Info from. According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable. Renewable Energy Systems Tax Credit Application Fee.

You are not claiming a Utah tax credit. When to File and Pay You must fi le your return and pay any tax. Claim the credit on your TC-40a form submit with your state taxes.

We are accepting applications for the tax credit programs listed below. To claim your solar tax credit in Utah you will need to do 2 things. See all our Solar Incentives by.

Welcome to the Utah energy tax credit portal. And dont forget the Federal rebate for installed solar systems is 30. Note that this tax credit will be reduced in value by 400 each year and expires completely in 2022 Utah is a Right to Solar.

Pin On Utah Ut Usa Capital Salt Lake City

Pin By Marianne On Dream Home Design Dream Home Design Infiltration House Design

How To Start A Solar Farm Business Truic

Page Not Found Sentinel Mission Space And Astronomy Universe Today Sentinel

Angular Unconformity Central Utah Pleistocene Gravel Overlying Faulted And Tilted Triassic Moenkopi Formation Photo Geology Rocks Geology Science And Nature

Solar Incentives In Utah Utah Energy Hub

Scale Ladder From Macro To Atomic Atom Macro Scale

Solar Power Supplies 10 Per Cent Of Japan S Peak Demand Solar Power Plant Solar Renewable Sources Of Energy

Infographic Nuclear Power Vs Energy Efficient Homes Nuclear Power Energy Efficiency Energy Efficiency Infographic

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Petroglyphs With Rings Or Concentric Circles Or Plasma Events Petroglyphs Electric Universe Theories About The Universe

How To Start A Solar Farm Small Business Trends

Blank Drivers License Template 3 Professional Templates Drivers License Id Card Template Licensing

Biggest 2400wh Power Station Solar Generator New Bluetti Eb240 Portable Backup Power Yout Solar Generator Portable Solar Generator Emergency Generator

Solar Tax Credit Details H R Block

The Excellent Unique Sales Lead Tracking Excel Template Xls Xlsformat Within Sales Lead Report Temp Sales Report Template Excel Templates Credit Card Tracker